Tax Strategies For Business Owners’ No One’s Telling You - Part 1

This is Part 1 of a series of unique tax strategies that most tax payers are unfamiliar with. The first tax hack that we’ll be talking about that every Canadian business owner needs to know are the replacement property rules.

What exactly is a replacement property?

A replacement property is a business property that is purchased, after having sold your former business property. By electing into the replacement property rules, you defer any capital gain or recaptured income that usually will be taxed on your tax return when you sell a business property. CRA has noted that “..there must be a correlation or causal relation between the disposition and the new acquisition”.

The geographic location does not matter, the purpose of the property is what matters. You can’t sell the building you work in and use the proceeds to buy stocks or other assets. You must purchase another building that you will be working in.

Your sale can be a voluntary disposition or involuntary disposition. Both have slightly different rules.

That’s all great. But who does this apply to?

If you are a professional services firm (accounting, legal, doctor, etc.) and operate out of a property you own and want to sell and move to another property, this will allow you to defer the tax on your sale. Or if you own a hotel and want to purchase a bigger hotel. Or any type of business that operates out of their own building and is looking to move.

Rules to be met

The voluntary rules do not apply to rental properties as it is excluded from the definition of former business property. However, if a portion of the building is for rental income the property can still qualify. Usually as long as more than 50% of the income is derived from the business.

How does the calculation work?

It is a bit tricky doing the calculation for both the deferred capital gain and the deferred recapture. I’ll show you the formula and then do an example to illustrate it. The formula for calculating the deferred capital gains and deferred recapture is:

For deferred gains - lesser of :

Proceeds less original cost of property disposed

Cost of replacement property less original cost of property disposed

For deferred recapture – lesser of:

(Lesser of proceeds and original cost of replacement property) less UCC of replaced property

Cost of replacement property

I said it was tricky. Let’s go through an example. Say you sold your building and land for $1.5m with a total cost of $300K. You then used the proceeds of $1.5m to buy a new building for $2m. The below graphic will show you the numbers.

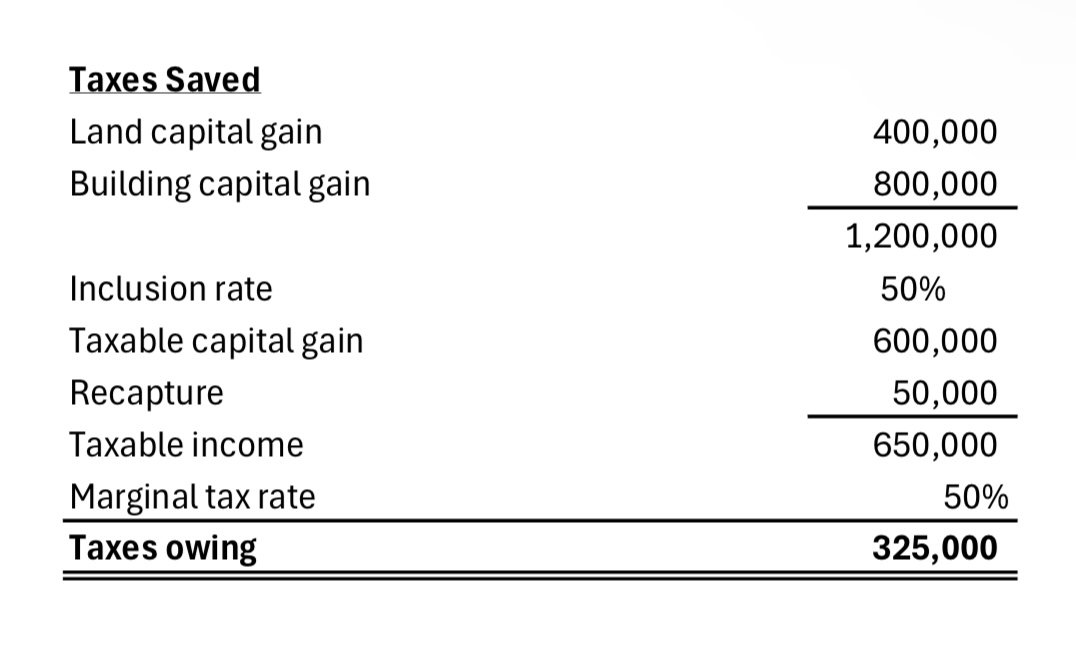

This shows you are able to defer a $400K capital gain on the land, a $800K capital gain on the building and $50K of recapture from the sale of the building. Your new land and building cost are $350K and $1.2m , respectively. The amount of taxes saved by using the replacement property election is:

The main thing to takeaway is that if all of the proceeds are reinvested into replacement property, you can defer all of the gain. If only a portion is reinvested, you can’t defer the whole gain.

Filing the election

You are able to buy the replacement property prior to selling your current property, in the year you sell your property or in the time frame shown above (12 or 24 months) following the sale of the property. To file the election and notify CRA, you simply attach a letter to CRA in your tax return describing your new and former property as well as a calculation outlined above that goes over the capital gain, recaptured income and new cost base of the replacement property.

What if I sell, file my return and then buy the replacement property at a later date?

Good question. Because you would have had to report your capital gain and recapture in the tax return and pay tax on it, you can request in your following return a request for an adjustment to your prior return that provides you with a refund a long with your election letter.

Instead of requesting an adjustment of your prior return, if you know you will be purchasing a replacement property in the time frame requirements, you can provide some type of security to CRA in lieu of the payment of taxes until you actually buy the property. This prevents you from having to pay the taxes and then receive a refund the following tax year.

Concluding Thoughts

Every business owner should be aware of the replacement property rules. It could allow them to not have to pay taxes and even reinvest their deferred taxes into larger properties for their benefit. The calculations can be tough to complete so I recommend you talk to your accountant before committing to this to make sure it is appropriate for your situation and done correctly.

DISCLAIMER: The articles posted on TaxCrunch should not be considered specific advice to anyone readying. Please reach out to a professional advisor to seek guidance on any issues mentioned in this post before acting upon anything written here. All posts are time sensitive to what is law at the time written and are subject to changes in legislation.