Can Canadians Sell Their US Property Tax Free?

I wrote about Canadian replacement property rules last week (see here) and then tweeted how the US have similar rules for their taxpayers but are way more advantageous.

I got a couple questions whether as a Canadian and non-US citizen, could someone buy US real estate and use the 1031 like-kind exchange?

The US allows their citizens (as either individuals, corporations or partnerships) under Section 1031 of their tax code to defer their taxes by performing a “like-kind exchange” where they can sell their investment properties or business properties, have a third party hold on to the proceeds (known as a Qualified Intermediary), and then reinvest the amount into other properties.

Their rules are much more liberal than in Canada in terms of the new property to buy but in the States you have only 180 days to reinvest the amount. You can see this really benefitting potential real estate development companies as they can go in, fix the place up, rent it out and then sell it for a big profit and roll the proceeds into another project without having to pay tax. Whereas in Canada, it cannot be investment/rental properties but just essentially properties your business operates out of.

Canadian holding US real estate – Using 1031

As a Canadian resident holding US real estate, you can utilize a 1031 in-kind exchange to defer your US taxes, provided you meet the 1031 requirements . However, under Canadian Income Tax rules, because the property is most likely a rental property and not a business property, you will have to recognize on your tax return a capital gain and any recapture of depreciation from the sale of the property (because it usually won’t meet the replacement property rules as well).

Usually when you sell US property you would need to file a US tax return and pay US taxes on the gain and then file your Canadian tax return and claim a foreign tax credit based on the amount of US taxes you paid. But because there would be no US taxes actually paid (due to the fact that you are using 1031), you can’t claim the foreign tax credit and will therefore be taxed on the full amount in your Canadian tax return.

When you eventually sell the US property down the road, file your US return and pay tax on your capital gain, you can claim a foreign tax credit in your Canadian tax return but this still results in an element of double taxation. You are paying Canadian tax initially, then tax upon eventual sale of the property.

Canadian holding US real estate - Not utilizing the 1031

If you sell the US property and don’t want to roll the proceeds into a new property but pay US taxes on the sale, when you go to file your Canadian tax return you can include the foreign tax credit of the amount of US taxes you paid. This should have the effect of essentially nullifying Canadian taxes owing. You will usually pay the highest amount owing in Canada or the States, not a combined amount of the two.

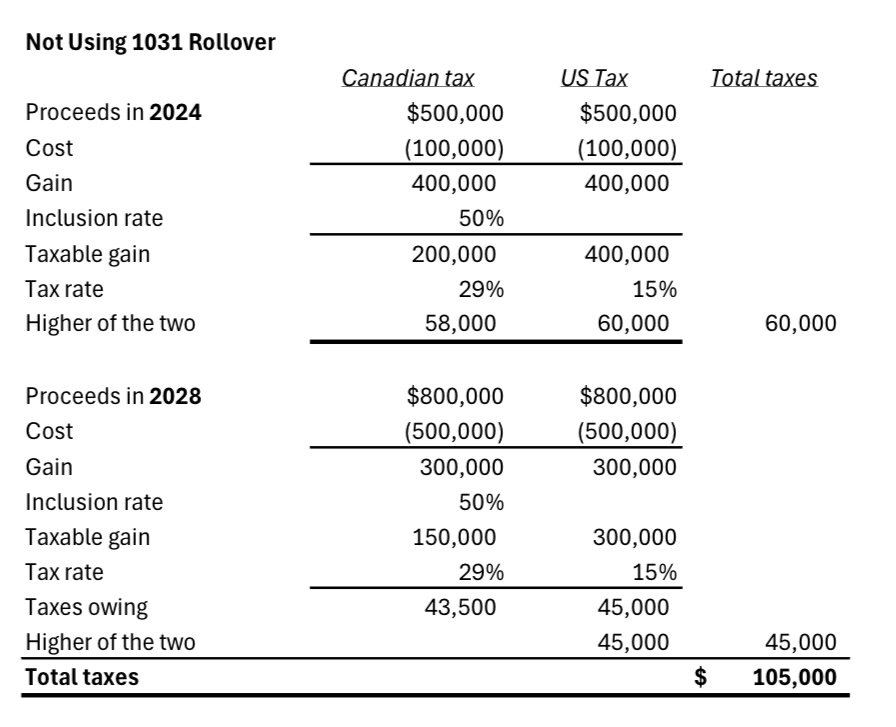

I’m a big fan of examples so I will demonstrate the tax difference with one. Let’s say you bought a rental property in the States for $100,000 in 2015 and it is now worth $500,000 in 2024 when you sell it. You purchase a similar property for $500,000 and in 2028 you think it will be worth $800,000. The first picture shows if you use the 1031 rollover and the second one is not using the rollover.

Based on a gain of $700,000 from the 1031 rollover, your effective tax rate is 28.3% (198K/700K).

Without using the 1031, your taxes will be $105,000 (essentially 15%) vs $198,000 when using 1031. So it might be better to actually pay the taxes than defer them using a 1031.

Holding US real estate using a Canadian corp.

When a Canadian corporation owns the US rental property and wishes to use the 1031 exchange, the same tax consequences occur as if held personally. The Canadian corp. will have to recognize the capital gain when the exchange is performed, and cannot use the foreign tax credit to help offset the tax because no US taxes were actually paid. Then when US property is later sold, there will be a double taxation event.

Holding it by owning a U.S. controlled corporation

International taxation is extremely complex, but if you hold the property in a U.S. corporation to use the 1031 exchange and defer any tax, as a Canadian there are certain “foreign accrual property income” (FAPI) rules and calculations that would have to be done but the gist is that you would have to report the capital gain in the year of the exchange personally. This defeats the purpose of the 1031 exchange because it results in the same double taxation event outlined above.

Each situation is different as the US have different tax laws for each State. There are also potential withholding taxes that will go into effect should you sell US property that were not taken into account here. It’s a very complicated topic that needs someone experienced in cross border transactions to look at. Good planning before selling the property or using the 1031 exchange goes a long way.

DISCLAIMER: The articles posted on TaxCrunch should not be considered specific advice to anyone readying. Please reach out to a professional advisor to seek guidance on any issues mentioned in this post before acting upon anything written here. All posts are time sensitive to what is law at the time written and are subject to changes in legislation.